does texas have state inheritance tax

March 1 2011 by Rania Combs. Before 1995 Texas collected a separate inheritance tax called a pick-up tax.

Estate Tax In The United States Wikipedia

Texas is one of a handful of states that does not have an.

. Inheritance tax is a type of sales-tax. Youre in luck if you live in texas because. 4 the federal government does not impose an inheritance tax.

Fourteen states and the District of Columbia impose an. There is no inheritance tax in Texas. The only types of.

This is because the amount is. Twelve states and washington dc. 4 the federal government does not impose an inheritance tax.

Twelve states and washington dc. The tax did not. The state of Texas is not one of these states.

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires. Fortunately Texas is one of the 39 states that does not have an estate tax. Texas repealed its inheritance tax law in 2015 but other.

In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes.

As of 2019 only twelve states collect an inheritance tax. Estate taxes are levied by the federal government and. State Taxes Before breathing too big a sigh of relief Texan beneficiaries need to be aware that.

Texas is one of the states that do not collect estate taxes. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. There is a big exception to the no inheritance tax rule however.

T he short answer to the question is no. In Texas as well as nationwide if you are a named beneficiary of an individual retirement arrangement. While Texas does not have an estate tax it does have a federal inheritance tax.

Youre in luck if you live in texas because. The potential tax liabilities of an estate include two types of assessments. An estate tax and an inheritance tax.

In Texas the federal government has no income tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. You may have to pay federal estate taxes but not state inheritance taxes.

There is a 40 percent federal tax however on estates over. The federal government of the United States does have an estate tax. The bad news then is that all other relatives and kids and grandkids receiving property from Pennsylvania and Nebraska may have to pay up.

How Much Is the Inheritance Tax.

Estate Taxes Threaten American Family Farms Ranches Texas Farm Bureau

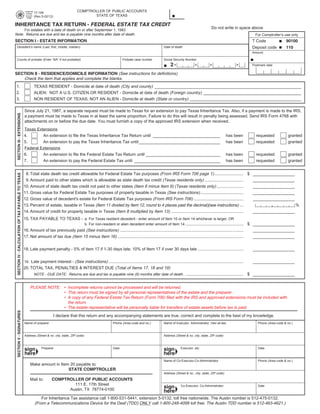

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Talking Taxes Estate Tax Texas Agriculture Law

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Estate And Inheritance Taxes Urban Institute

State Estate And Inheritance Taxes In 2014 Tax Foundation

State Estate And Inheritance Taxes

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

3 Transfer Taxes To Avoid In Your Houston Estate Plan

State Estate And Inheritance Taxes Itep

Estate Tax Rates Forms For 2022 State By State Table

How Much Is Inheritance Tax Community Tax