oklahoma franchise tax form

Please allow up to 10 business days to receive your forms. Polston Tax is one of the few top-rated tax resolution companies that is fully equipped to help solve your tax problems.

Writing 6 Digit Numbers In Expanded Form Worksheets Numbers In Expanded Form Expanded Form Expanded Form Worksheets

Form 540 is the general-purpose income tax return form for California residents.

. Your data is secured with SSL Secure Socket Layer and 128-bit encryption. Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. Mail Required Field.

We would like to show you a description here but the site wont allow us. You can check the status of your Form 1040-X Amended US. To register your account with OkTAP you will need the following information.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Get forms by US. Oklahoma Tax Commission Division Phone Numbers.

State of California Franchise Tax Board Corporate Logo. Do not mail this form if you use Web Pay. It covers the most common credits and is also the most used tax form for California residents.

Part-time or nonresident filers must instead file form 540NR. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. Franchise tax rates can vary based on the business and state the company operates in.

Your annual LLC tax will be due on September 15 2020 15th day of the 4th month. Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Oklahoma Tax Commission Post Office Box 26920 Oklahoma City OK. You form a new LLC and register with SOS on June 18 2020. Use FTB 3522.

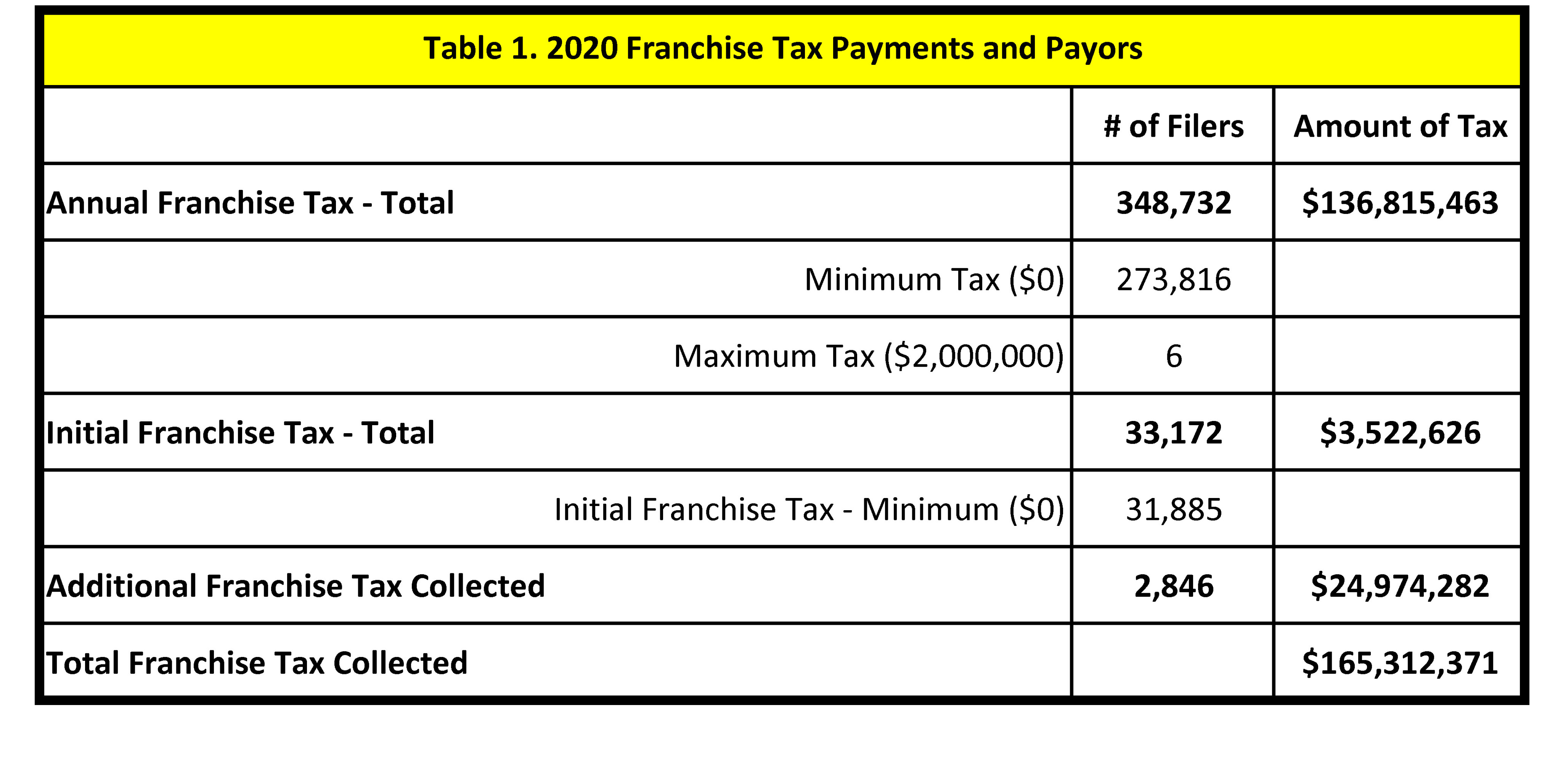

When the economy goes into a recession corporate profits drop and franchise tax revenues also drop. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. We last updated California 540 Tax Table in April 2022 from the California Franchise Tax Board.

You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP. Estimated Tax for Individuals 2022 Form 540-ES Estimated Tax for Individuals 540-ES Form 1 at bottom of page ONLINE SERVICES. We will update this page with a new version of the form for 2023 as.

Bi-Annual Exception Details is available to any teams who are below the Luxury Tax Apron 155196200 and did not use this exception in the previous. Get forms by US. Safety measures are in place to protect your tax information.

Each state has different criteria for who needs to pay franchise taxes and how they calculate the tax. To add or change a location address fill out form BT-115-C-W and mail to. Rural Electric Co-Op License.

How to use sales tax exemption certificates in California. Franchise Tax 405 521-3160. Use Web Pay and enjoy the ease of our free online payment service.

OTC FORM TYPE OF RETURN NORMAL ALLOWED OW8-ES Oklahoma Individual Estimated Tax Coupon 4152021 6152021 OW8-ESC Oklahoma Corporate Fiduciary and Partnership. States may calculate franchise tax based on. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. I am trying to find out if I can get a Form 4506-T. The Oklahoma franchise tax is mandatory for all for-profit corporations including S-corporations partnerships and limited liability companies organized and maintained in Oklahoma.

Required Field Form Number Separate form numbers with a comma Required Field Type the characters from the picture. Non-Taxpayer Mid-Level Exception Details is awarded annually to teams who are above the cap but below the Luxury Tax Apron 155196200 and can be used for contracts up to 4 years in length. Professional Tax Resolution Services That Deliver Results The Polston Tax team consists of top tax attorneys who have extensive experience resolving IRS and state tax issues reducing or eliminating liens and wage.

With corporate franchise tax collection these tax revenues are the most volatile. Individual Income Tax Return using the Wheres My Amended Return. You can schedule your payments up to one year in advance.

Account Maintenance 405 521-4271. Go to ftbcagovpay for more information. Your payment amount is the same as your routing number account number or phone number.

For example in 2007 which was considered an expansion year. Gross Production Lease Records. Gross Production 405 521-3251.

Click on the tab Links to Other Motor Vehicle Agencies at the top of this page for the Department of Public Safety the Oklahoma Tax Commission the Used Motor Vehicle Parts Commission or additional agencies that handle various motor vehicle related functions. The state franchise tax rate can vastly differ depending on the states tax rules.

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

Oklahoma Taxpayer Access Point

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

Taxpayers Federation Of Illinois Illinois Franchise Tax Still A Bad Idea

What Happens When You Miss Your Tax Extension Deadline Brotman Law

Pin By Home Care Assistance Of Rhode On Home Care Assistance Blog Checklist Template Planning Checklist Checklist

California Tax Forms H R Block

Oklahoma Tax Commission Facebook

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Top Earning Estates For 2019 Estate Planning Attorney Estate Planning Attorney At Law

Missouri Income Tax Rate And Brackets H R Block

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)